July Property Market Update

Victorian Premier, Daniel Andrews, declares “State of Disaster”

On Sunday 2nd August 2020, Daniel Andrews declared a “State of Disaster” in Victoria, which imposed Stage Four lockdown restrictions across Metro Melbourne effective 2nd August 2020. He also reinstated Stage Three lockdown measures for the rest of Victoria effective 6th August 2020. Both lockdowns are due to be in place for the next six weeks.

Members of the Victorian real estate industry are pushing for these regulations to be amended. For now, here are the implications of Stage Three and Four lockdowns for Victorian real estate:

Stage 4 Lockdown: Metro Melbourne

All real estate activity must be conducted 100% online. Therefore, 1:1 private inspections must be suspended for the next six weeks.

Stage 3 Lockdown: Regional Victoria

Much like the first lockdown we experienced, all auctions and group inspections must shift online. However, 1:1 inspections (i.e., the vendor and one household) are permitted to continue, provided COVID-safe precautions are observed at all times.

While Stage Three and Four restrictions are certainly not ideal, we remain focused on helping our vendors navigate these unprecedented times. Digital tools are available to help vendors continue to advertise their homes through these lockdowns, such as Realestate.com.au’s Digital Inspections tool.

Throughout lockdown periods, people tend to have more time on their hands. As we have seen in previous lockdown scenarios, search activity will likely increase since buyers have more time to consider what they truly want from their next property. Serious buyers may begin their search so that they are prepared to secure their dream home when restrictions lift September.

National Rent Values Fell by -0.5% in this past Quarter (Q4 FY20)

Over the June quarter, national rent values fell by -0.5%, which is the biggest drop we have experienced since 2018. Regional rental markets were more resilient, falling -0.2% compared to a downturn of -0.7% across capital cities. According to CoreLogic, this drop is mainly due to an increase in available properties and a decrease in demand from potential tenants.

That said, rental search activity on Realestate.com.au has reportedly risen by 39% over the quarter ending this June. Our portals are suggesting this surge comes from tenants with relative stability who may be looking for better rental properties or something more affordable. These tenants likely have a lower sense of urgency, which means although search activity has increased, their consideration period has too.

To navigate these unprecedented times, give your property the best chance at being successfully leased. This includes conducting necessary maintenance and ensuring your property is move-in ready. We also suggest researching your local area to see the prices at which similar properties have recently been rented to gauge whether you need to adjust your asking price.

‘For Sale’ Property Market Remains Relatively Buoyant Through July

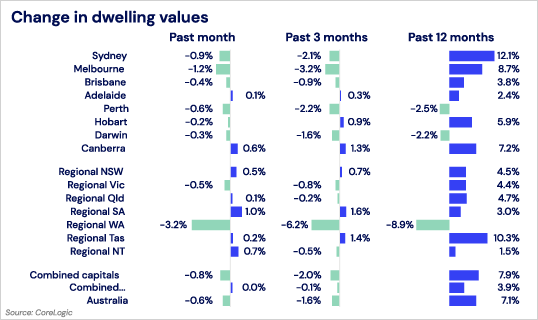

The national housing value experienced a third consecutive decline, dropping -0.6% this July, according to CoreLogic’s home value index. However, it is worth noting this is a slight improvement from June’s downturn of -0.7%.

Most capital cities experienced declines except for Canberra and Adelaide, which managed to demonstrate growth of +0.6% and +0.1% respectively.

In line with previous trends, regional areas are showing greater resilience than their metro counterparts. Combined capital city housing values dropped -0.8% this July, whereas combined regional values remained the same as they were in June.

Over the last quarter (Q4 FY20), the market experienced an overall drop of -1.6%. However, it is important to remember this result is not grave relative to industry forecasts that predicted the market would drop between 10-20%. What’s more, national housing values are still +7.1% higher than they were this time last year.

Realestate.com.au Survey Demonstrates Supply-Demand Imbalance

Realestate.com.au conducted a site-wide survey throughout May to July, whereby approximately 5,000 website visitors were successfully surveyed. They ensured diversity by surveying visitors on various parts of their website (i.e., buy, sell, rent, etc.)

Amongst the questions posed in the survey, two questions stood out, demonstrating market sentiment and the imbalance between supply and demand.

When asked if they thought now was a good time to sell, only 20% said yes. However, when respondents were asked if they thought now was a good time to buy, a massive 48% said yes.

| Participant responses when asked if they thought now was a good time to sell | Participant responses when asked if they thought now was a good time to buy |

|  |

According to our real estate portals, listing numbers are about 15% lower than this time last year. However, there are still many active buyers in the market – those who held financial stability through the pandemic and those who can afford to buy due to government stimulus. In fact, just last week it was announced that NSW is extending and expanding temporary stamp duty exemptions over the next 12 months, which is expected to further stimulate buyer activity.

Wrapping it up

A combination of record-low interest rates, loan repayment holidays, and strong government stimulus packages have supported the real estate market to date and will continue to do so over the coming months. While the full effects of COVID-19 continue to remain unclear, a supported market and the imbalance between property supply and buyer demand indicate now is a good time to list your property on the market.

If you need advice about selling during COVID-19, or if you have questions about the process of selling privately, call our Private Property Specialists anytime on 1300 003 726. We’re always happy to help.

References

- Baxter, L. (2020, August 02). COVID-19: New restrictions as Victoria declared ‘state of disaster’. Retrieved August 04, 2020, from https://www.realestate.com.au/news/covid-19-new-restrictions-as-victoria-declared-state-of-disaster/

- Baxter, L. (2020, July 29). Australia’s New Million-Dollar Suburbs Revealed. Retrieved August 04, 2020, from https://www.realestate.com.au/news/australias-new-million-dollar-suburbs-revealed/

- (2020, July 28). National Rents Fall By Half A Percent Over The June Quarter As COVID-19 Pivots The Trajectory Of The Rental Market. Retrieved August 04, 2020, from https://www.corelogic.com.au/news/national-rents-fall-half-percent-over-june-quarter-covid-19-pivots-trajectory-rental-market

- Harling, J. (2020, August 03). Australian Housing Values Continue To Drift Lower, Falling 0.6% In July As The COVID Driven Housing Downturn Moves Through A Third Month Of Orderly Decline. Retrieved August 04, 2020, from https://www.corelogic.com.au/news/australian-housing-values-continue-drift-lower-falling-06-july-covid-driven-housing-downturn?utm_medium=email

- Heagney, M. (2020, August 02). Melbourne property market to continue under stage four restrictions. Retrieved August 04, 2020, from https://www.domain.com.au/news/melbourne-property-market-to-continue-under-stage-four-restrictions-974134/

- Heagney, M. (2020, August 03). Melbourne real estate industry could come to a grinding halt under strict new rules. Retrieved August 04, 2020, from https://www.domain.com.au/news/melbourne-real-estate-industry-could-be-closed-under-strict-new-rules-974368/

- Landy, S. (2020, August 03). Victoria stage four restrictions: How COVID lockdown will affect property and construction industry. Retrieved August 04, 2020, from https://www.realestate.com.au/news/victoria-stage-four-restrictions-how-covid-lockdown-will-affect-property-and-construction-industry/

- Landy, S. (2020, August 04). Victoria stage four restrictions: How COVID lockdown will affect real estate, inspections, auctions. Retrieved August 04, 2020, from https://www.realestate.com.au/news/victoria-stage-four-restrictions-how-covid-lockdown-will-affect-real-estate-inspections-auctions/

- Lee, T. (2020, August 03). Visualised: How Australia’s attitude to property shifted over COVID-19. Retrieved August 04, 2020, from https://www.realestate.com.au/insights/visualised-how-australias-attitude-to-property-shifted-over-covid-19/?page=rea%3Anews%3Apost

Email

Email  Twitter

Twitter  Facebook

Facebook