October Property Market Update

National Dwelling Values Continue to Recuperate

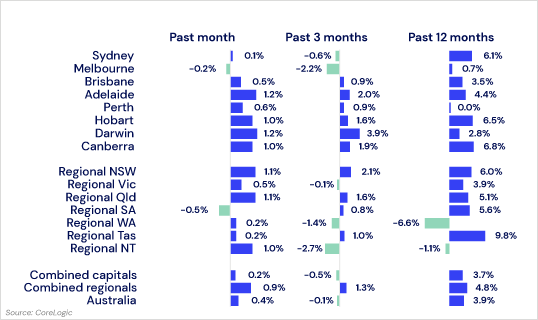

Australian dwelling values have finally made it into the green with a 0.4% rise this October. The tale between regional and metro housing values remains unchanged, with overall regional performance outshining metro areas. The only declines recorded this October came from metro Melbourne (-0.2%) and regional South Australia (-0.5%). (Lawless, 2020)

RBA Cash Rate Cut Set to Further Stimulate Demand

Current Market Trends

Melbourne’s Come Back Story

Melbourne’s real estate market has sprung back into action after Victoria’s second wave restrictions eased in September. In fact, New Listing volumes jumped 330% in the four weeks leading to 18th October. While this statistic sounds impressive, there are a few thoughts to consider. (Owen, 2020)

One area of concern is whether this increase in listing volume is fuelled by distressed listings because of heightened unemployment rates and households unable to afford their mortgages. However, while there are sure to be distressed listings in this mix of listings, early data from our property portals indicate this boost is likely a market rebound because Melbourne vendors have been greeted with fierce pent up buyer demand.

Tree Change Sea Change & Job Markets

The pandemic has influenced a shift to regional areas for buyers and renters alike. Before COVID-19, suburbs just outside of metro areas were already seeing an increase in demand. However, the effects of COVID-19 have accelerated demand in these areas and opened the gateway for the deeper regional suburbs. (Conisbee, 2020)

Job creation is one of the reasons regional Australia has seen a recent boom – for example, a surge in Australia’s mining industry. The pandemic has crippled other countries’ ability to maintain sufficient production levels, which has created an opportunity for Australia to fill the gap. Given current unemployment rates, wherever job opportunities are created, demand will likely follow.

Lifestyle change is another main reason for which regional areas have performed well. Many people are now accustomed to the work-from-home (WFH) lifestyle, which has weakened the necessity to live close to CBDs. After experiencing COVID-induced lockdowns some people have realised they want a less congested lifestyle, opting for tree or sea change.

While regional demand is currently a strong trend, experts are unclear on how this will play out in the long-term as Australia finds its sense of normality.

Wrapping it up

October has proven that Australia’s real estate market is on the road to recovery. With housing prices on the rise and demand holding strong, you can be confident now is an excellent time list your property on the market.

If you have questions about the process of selling privately, call our Private Property Specialists today on 1300 003 726. We're always happy to help.

Index

- * Weekly Property Demand: Number of high-intent buy listing interactions on realestate.com.au indexed against a long-term cumulative average. *LTA calculated as cumulative average since Jan 2017 (Kusher, 2020)

- ^ Weekly Rental Demand: Number of high-intent rental listing interactions on realestate.com.au indexed against a long-term cumulative average. *LTA calculated as cumulative average since Jan 2017 (Kusher,2020)

References

- Bell, M. (2020, November 12). Over half of Aussie tenants are expected to struggle to afford their rent as a result of COVID-19. Retrieved November 13, 2020, from https://www.realestate.com.au/news/over-half-of-australians-are-struggling-to-afford-their-rent-as-a-result-of-covid19/

- Conisbee, N. (2020, November 05). REA Insights Regional Australia Report 2020. Retrieved November 04, 2020, from https://www.realestate.com.au/insights/rea-insights-regional-australia-report-2020/

- Kusher, C. (2020, October 28). October 28 REA Insights Weekly Property Demand Report, 2020. Retrieved November 4, 2020, from https://www.realestate.com.au/insights/october-28-rea-insights-weekly-property-demand-report-2020/

- Kusher, C. (2020, October 28). October 28 REA Insights Weekly Rental Demand Report, 2020. Retrieved November 4, 2020, from https://www.realestate.com.au/insights/october-28-rea-insights-weekly-rental-demand-report-2020/

- Lawless, T. (2020, November 02). CoreLogic October home value indices: Australian housing values move into recovery mode. Retrieved November 04, 2020, from https://www.corelogic.com.au/news/corelogic-october-home-value-indices

- McLean, S. (2020, November 03). RBA Makes Cup Day Rate Cut As Economy Bounces Back. Retrieved November 05, 2020, from https://www.realestate.com.au/news/rba-makes-cup-day-rate-cut-as-economy-bounces-back/

- Owen, E. (2020, October 22). New listings soar across Melbourne, overtaking Sydney as restrictions ease. Retrieved November 13, 2020, from https://www.corelogic.com.au/news/new-listings-soar-across-melbourne-overtaking-sydney-restrictions-ease

Email

Email  Twitter

Twitter  Facebook

Facebook